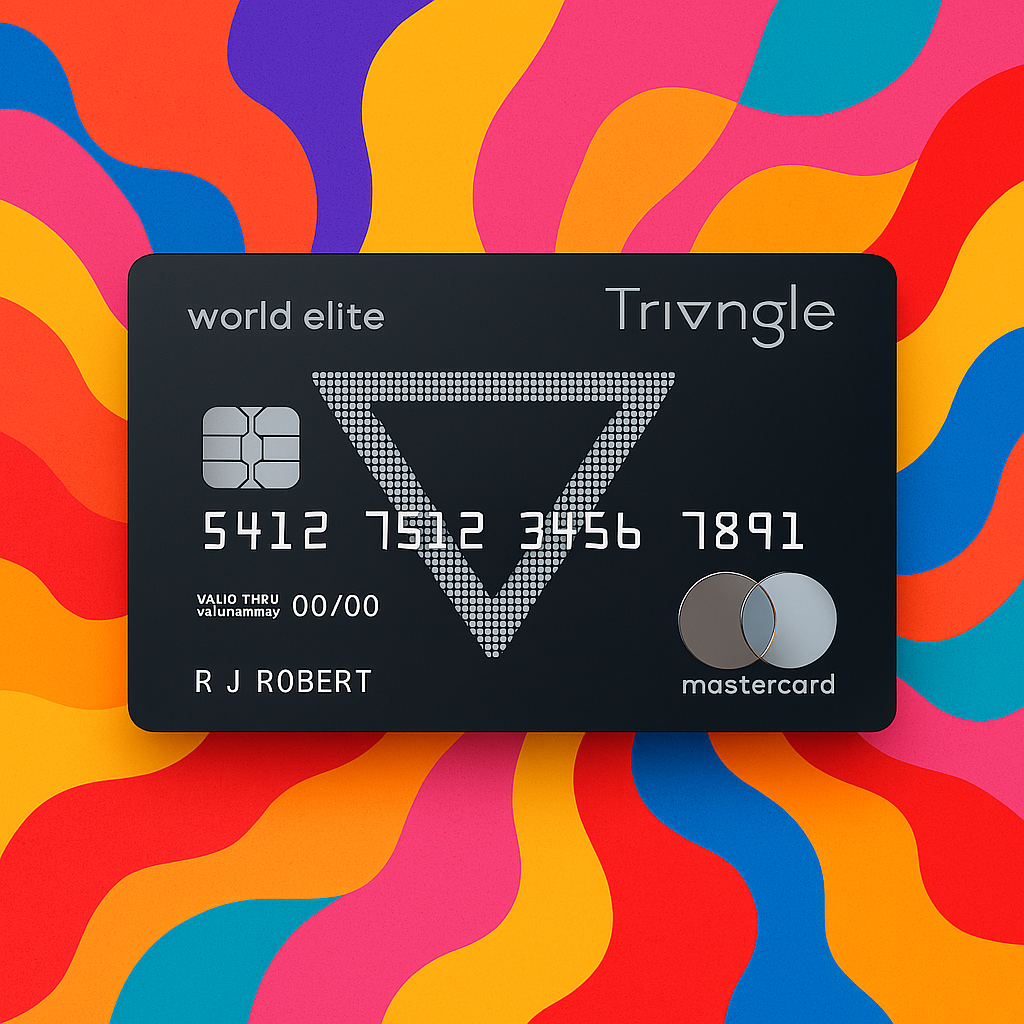

The Triangle World Elite Mastercard is more than just a credit card. It offers its users a unique shopping The Triangle World Elite Mastercard isn’t just a credit card; it’s a whole shopping experience. With exclusive perks, fast rewards, and real benefits, it’s designed for those looking to make the most of their spending. If you’re aiming to get more out of your purchases, this card could be the perfect fit, especially for those who want more control over their finances.

On top of that, the card comes with extra benefits like purchase protection insurance and roadside assistance, giving you peace of mind as you go about your daily life. These added features bring real value to cardholders who want more than just points. The best part? With an affordable annual fee, you can access all of this without stretching your budget.

Page Contents

ToggleKey features of the credit card

The Triangle World Elite Mastercard is ideal for anyone who wants to maximize their spending by earning rewards easily. One of the most appealing features is the ability to earn points on purchases made at a wide range of partner stores, plus access to exclusive promotions and discounts. The user-friendly online platform makes it simple to keep track of your spending and rewards.

Another great perk is the first-year annual fee waiver, making it even more enticing to sign up. This allows you to experience all the benefits right away without having to worry about any extra costs. After the first year, the annual fee is relatively low compared to other premium cards, making the Triangle World Elite Mastercard a great choice for those looking to boost their rewards without going over budget.

How does the annual fee work?

One of the most attractive aspects of the Triangle World Elite Mastercard is the absence of an annual fee for the first year. This means you can enjoy all the benefits of the card without any additional charges, which makes it a smart, economical option for those who want to get the most out of their rewards. The first-year fee waiver is especially great for new cardholders, as it allows you to test out all the perks without worrying about upfront costs. What’s even better is that, for those who keep using the card and meet certain spending requirements, the annual fee waiver can be extended.

How is the credit limit determined?

The credit limit on the Triangle World Elite Mastercard is determined through a detailed review of your financial history, including factors like your credit score, income, and ability to repay. Traditional credit cards usually require proof of a minimum income and a solid credit history for approval. With prepaid cards, the limit is determined by how much you deposit, giving you more control over your spending. In addition, the bank may periodically review your credit limit, adjusting it based on changes in your financial situation, like an increase in income or reduced debt. If requested, you can also apply for a credit limit increase, as long as the credit review is positive.

Pros and cons of the Credit Card

The Triangle World Elite Mastercard offers several advantages that cater to different types of consumers. In addition to fast rewards, it provides exclusive benefits like insurance and assistance that really come in handy during everyday situations. These perks can add significant value for those who use their card frequently. Overall, it’s a smart option for anyone looking to optimize their everyday shopping with extra security.

However, like any financial product, the Triangle World Elite Mastercard has its downsides. The main one is that it requires a good credit score for approval, meaning those with poor credit might find it harder to qualify. Additionally, rewards are limited to participating stores, which might not be ideal for people who want more freedom in where they shop.

| Pros | Cons |

|---|---|

| Accelerated rewards on purchases | Requires a good credit score for approval |

| Exclusive additional benefits | Rewards limited to participating stores |

| Annual fee waiver in the first year |

Who can apply for this card?

The Triangle World Elite Mastercard is available to those who meet basic application requirements. To apply, you need to be at least 18 years old and demonstrate a minimum monthly income, as required by the bank. These initial criteria ensure responsible lending and help maintain the card’s exclusive benefits. Meeting them is the first step to unlocking everything this card has to offer.

Additionally, your credit history will be reviewed, and it’s important to have a solid financial background. A strong credit profile increases your chances of approval and shows your ability to manage credit responsibly. This card is perfect for those seeking exclusive benefits but isn’t available to people with poor credit. Here are the main requirements for applying for the Triangle World Elite Mastercard:

- Minimum age of 18

- Minimum income requirement (varies by bank)

- Good credit history

- Proof of income

How to apply for the card?

You can apply for the Triangle World Elite Mastercard in several ways, depending on your preference. Applications are accepted through the official bank website, mobile app, or even in-person at select participating stores. This flexibility allows you to choose the method that feels most convenient. Below, we’ll break down each option in more detail.

In all cases, you’ll need to fill out an application form and provide documents such as proof of identity and proof of income. Having these documents ready beforehand will speed up the process and help avoid unnecessary delays. Once your application is submitted, the bank will review your information carefully. You’ll then be notified of the decision, often within a few business days.

Via the website

You can apply for the card by visiting the official bank website. Simply complete the form with your personal and financial details, then submit your request securely. The process is quick, intuitive, and available 24/7, giving you full control over when and how to apply. You can also track your application status online with ease.

Via the app

You can also apply for the card through the official bank app, available for download on most smartphones. Once logged in, navigate to the credit card section and select the Triangle World Elite Mastercard. The application process is straightforward and mirrors the website version. It’s perfect for those who prefer managing everything on their phone.

In Store or Agency

If you prefer in-person assistance, you can visit a participating store or agency to apply for the Triangle World Elite Mastercard. A representative will help guide you through the application and answer any questions you may have. This option is great if you feel more comfortable with face-to-face support. It also gives you the chance to clarify details on the spot.